Jessica Pilon-Summons

12th October 2022

Financial resilience is top of mind for most of us right now. You may be reviewing your expenses and thinking, how can I reduce my costs?

Feeling the post Christmas debt bulge?

You are not alone.

Australians spend over $31.6 million in the month before Christmas, a figure well beyond pre pandemic spending*.

You may be looking at your festive spending and thinking, how can I reduce my costs?

Many people know that refinancing can help them to get a lower interest rate on their home loan, but you might not have considered other ways refinancing can help you consolidate your debts and pay less.

When it comes to debt, the goal is to pay as little interest as possible.

One way to achieve this is by consolidating personal loans (e.g. credit cards, car loans or any debt with high interest rates) into your mortgage which generally has a much lower interest rate.

By doing this you:

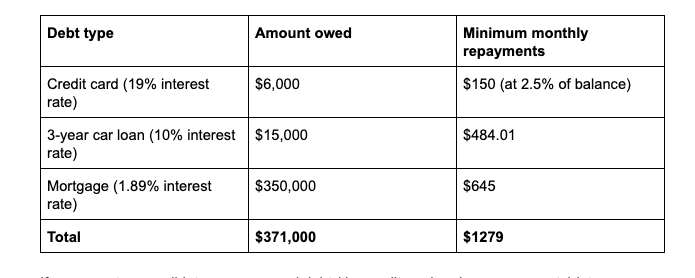

Here is how this might look. Say you have the following expenses:

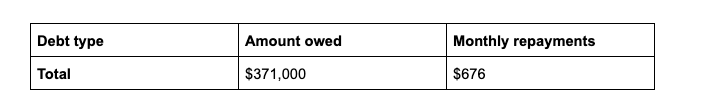

If you were to consolidate your personal debt (the credit card and car repayments) into your mortgage, your expenses each month may look like:

As you can see in the scenario above, you stand to save $603 per month by consolidating your expenses.

The RBA’s most recent announcement set the cash rate to a historic low of 0.10% which is resulting in interest rates at generational lows.

Right now many lenders and banks are offering incentives to refinance, some in the thousands of dollars!

Now is an opportune time to take a look at your current loan and see if you could be on a better deal.

At the moment, if your comparison rate doesn’t start with a 2, you should call us to see how we may be able to help you renegotiate or refinance to a better rate.

Contact an expert brokerIt’s worth considering that this strategy isn’t foolproof. Whilst you are getting the benefit of simplifying the number of repayments you are making each month and paying less interest in the short term, if your payments stretch over a longer period, you may end up paying more over the lifetime of your debt.

Paying off larger amounts than your minimum repayment when you are able to can help overcome this and make sure you get the full benefit of consolidating your debt.

The real key is to maintain the same level of repayments with the new structure as you were with the old structure so you pay the principal off much faster and save big time over the long run.

If you’re concerned about your post Christmas debt, here are three simple steps you can take to get back on track:

You don’t need to do this alone. UNO’s team of brokers can help you through the process of refinancing and advise what options suit your needs.