Sarah Megginson

13th October 2022

Young people can go out and enjoy a cup of coffee and smashed avocado for brunch, and still afford to buy a house. It just needs to be a purposeful decision, says a property expert.

It was over raisin toast and orange juice that 33-year-old marketing manager Adam Smith* had his epiphany: “The only way I will ever own my own home is if I inherit one.”

Adam and his wife earned decent money – almost $150k between them – but, with a toddler running afoot and another on the way, Adam knew their chances of getting into the housing market any time soon were but a dream.

Sure, the brunches and occasional date nights could go, although the savings would really only amount to a couple of grand a year, if that.

“How is that going to put a dent in the $100,000 deposit we’ll need to buy in this city?” he wondered.

Of course, Adam is not alone. He joins a chorus of 20- and 30-somethings, mostly in Sydney and Melbourne, who have all but given up on the goal of owning a home.

“The housing affordability crisis is real,” confirms property valuer Anna Porter from Suburbanite. “And if our unwittingly titled ‘smashed avocado’ generation is stuck in one of the country’s most unaffordable rental markets, how can we expect them to save for a home of their own?”

If you’re in the same boat, the situation may seem dire. However, here’s the skinny: young people can go out and enjoy a cup of coffee and a smashed avo for brunch, and still afford to buy a house. It doesn’t need to be an either/or proposition.

What it does need to be is a purposeful decision, says property educator Helen Collier-Kogtevs, managing director of Real Wealth Australia.

“I’ve been hearing how property prices are ‘unaffordable’ ever since I can remember,” she says. “But it’s all relative. I do believe it is still possible [to buy property] – it’s all about how you spend and save your money.”

Any young person starting out should be aiming to put aside a set amount of savings every pay packet, for example. It could be as little as $20, if that’s all you can afford initially: the power is in building the habit.

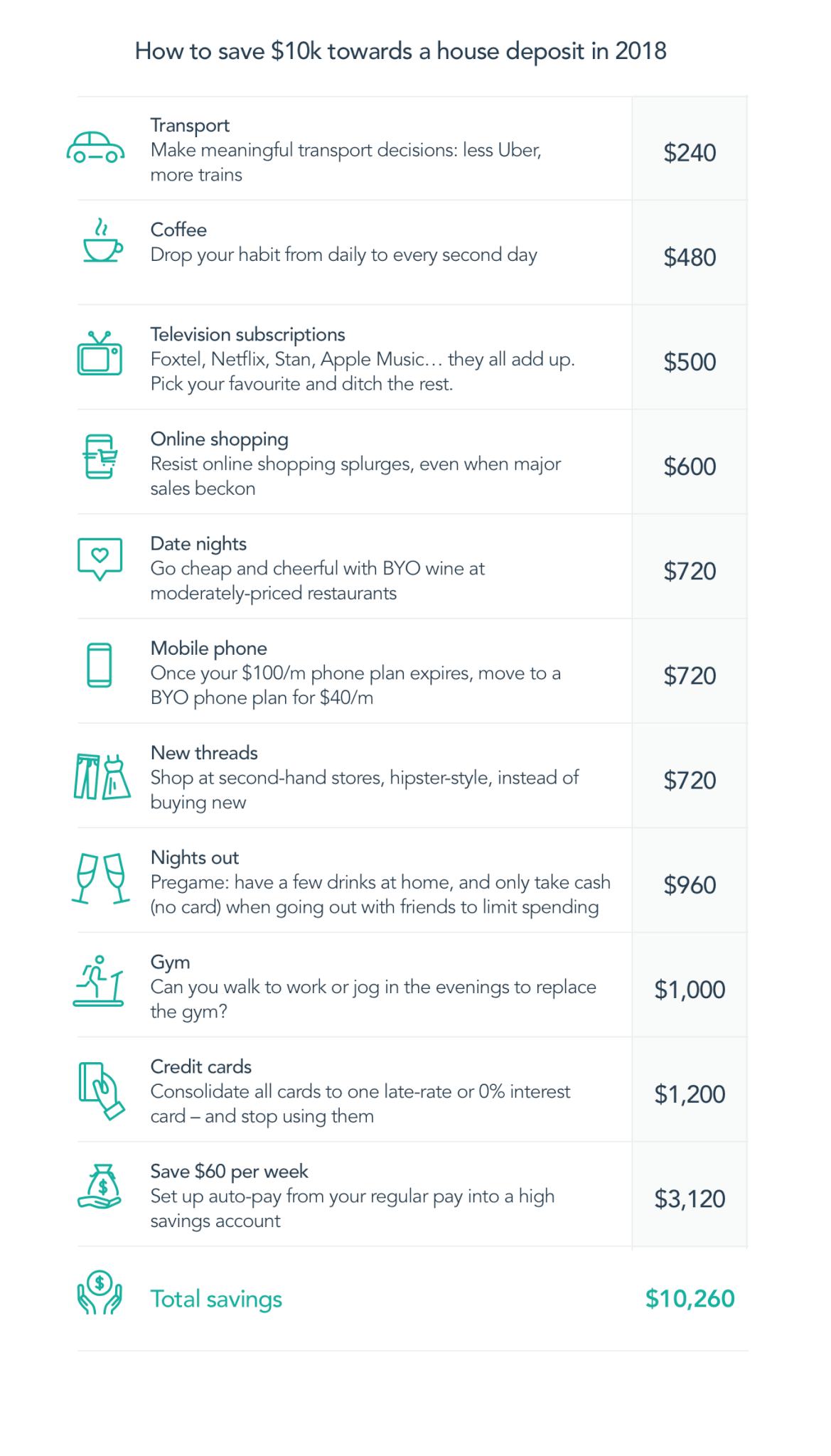

Let’s say you can save $50 per week: that’s $2,600 annually in your home deposit coffers. So how else can you boost your bank balance?

“A regular savings plan is a great start, but adjusting your spending habits can accelerate your savings and get you closer to your goal of being a homebuyer,” Collier-Kogtevs says.

This is where it boils down to your values. Do you truly love brunch? Does the thought of skipping the crispy bacon on a Sunday morning make the week ahead seem grim?

If this is the case, then by all means, continue to brunch. But at the same time, look for other ways to trim financial fat.

“When you go out with friends, instead of shouting everyone a drink, just pay for your own and keep it to a limit of $50,” Collier-Kogtevs says. “Carpooling is another way to save on costs and when your $120 a month phone plan runs out, instead of upgrading to the latest Galaxy or iPhone, keep it for another year and go on a BYO phone plan that gives you unlimited calls for around $40 a month.

“I have one student who is single and earns around $80k p.a., and he managed to save a deposit for his first property… and there was no mum and dad to hand over a deposit.

“He got smart about how he spent his money: cooks a little more often, but still enjoys his coffee and avo. He shops around for things he needs or waits for the sales, and holidays are more local than international. But he is now booked to travel overseas to America for two months in 2018.”

Frugality pays, people. Just be frugal in the right areas, and you’ll be well on your way to mortgage bliss.

*not his real name

This information is general in nature and you should always seek professional advice when making financial decisions.This information in this article is general only and does not take into account your individual circumstances. It should not be relied upon to make any financial decisions. UNO can’t make a recommendation until we complete an assessment of your requirements and objectives and your financial position. Interest rates, and other product information included in this article, are subject to change at any time at the complete discretion of each lender.