Stamp duty calculator:

UNO’s comprehensive guide

You’ve no doubt heard of stamp duty – but how much is it going to cost you? We’ve compiled a comprehensive list of answers to your stamp duty questions.

Stamp duty is a tax on written documents and certain transactions imposed by state and territory governments. It can vary depending on the state or territory and, according to the Australian Government website, may be called stamp duty, transfer duty or general duty.

As well as a tax on leases, mortgages and the transfer of property (including businesses, real estate and some shares), stamp duty also applies to motor vehicle registration and transfers; insurance policies; and hire purchase agreements. Essentially, stamp duty covers the cost of switching the title of the property and changing ownership details.

Most state revenue websites have a stamp duty calculator that calculates the rates home buyers will have to pay.

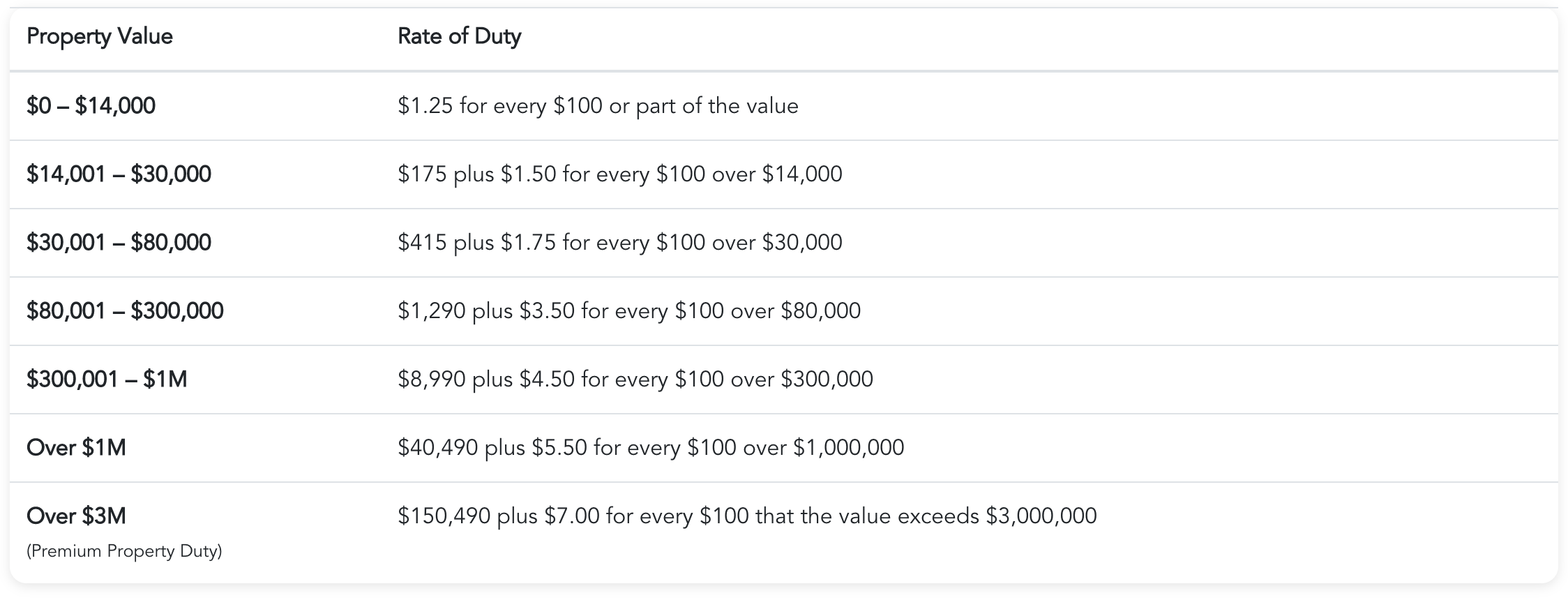

For example, the current rates and thresholds for NSW are outlined in the table below:

uno’s calculator enables users in any state to work out stamp duty by entering a number of variables.

Why is it called stamp duty?

Stamp duty is a British term, although the duty itself is thought to have originated in Spain. Historically, legal documents such as cheques, receipts, marriage licences and land transactions were impressed with an actual stamp to show that duty had been paid and the document was legally effective.

Do home buyers in other countries pay stamp duty?

Stamp duty is prevalent around the world, although its name differs depending on where you are. In China and Denmark it’s also called stamp duty, for example. While in the United States it’s more commonly referred to as Closing Costs, which is actually an umbrella term for all the costs paid at the time of transaction, including government taxes.

How much stamp duty do we pay in Australia?

Stamp duties are levied on every property purchase in Australia. How much you pay varies depending on the property’s location, whether you’re a first home buyer, the property value and whether you intend to live in the house or use it for investment purposes. The property being a new or established home can also affect the amount of stamp duty you pay.

How is it calculated?

A stamp duty calculator relies on a sliding scale of taxation and different variables, including the value of the property, to come up with a final figure. You’ll be asked to enter information such as the cost of the property you are purchasing, its location, the type of property (e.g. house or unit), what it will be used for (occupancy or investment) and other variables.

A general rule is that the more expensive the property, the higher the tax on it. But it’s not always this simple. Stamp duty varies greatly depending on the state in which you are buying a property. Most states separate the tax you pay into value categories, such as $300,000–$1m, for example, then charge a lump sum plus an extra fee for every $100 spent over the lower end of the category.

In NSW, for example, for a property in the $300,000–$1m bracket, a home buyer will be charged $8,990 plus $4.50 for every $100 that the value of the property exceeds $300,000.

Are there any ways to avoid or minimise stamp duty?

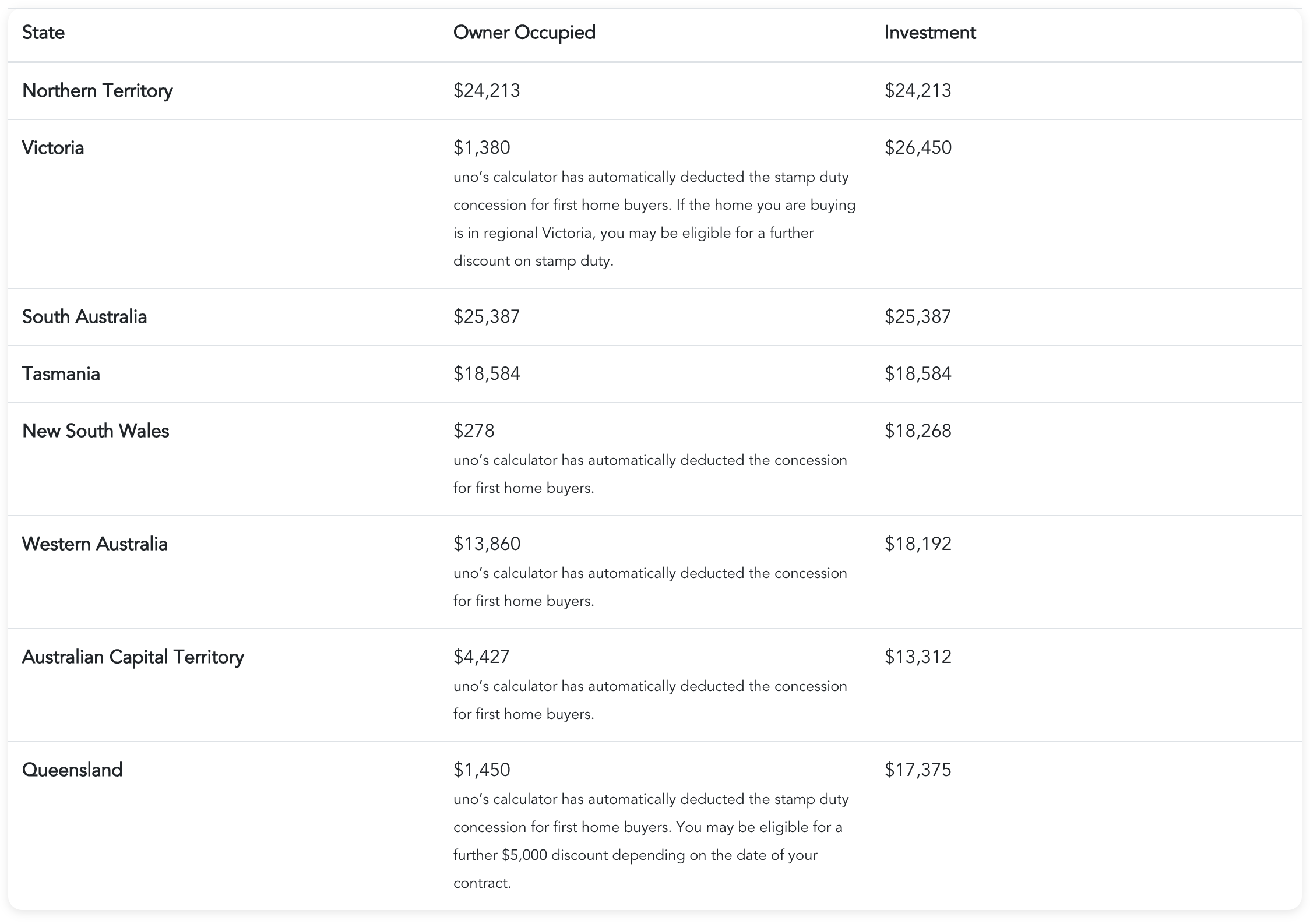

Many states have first home buyer concessions and grants. These are subject to change so it’s a good idea to check the revenue site in your state for updates and amendments. We’ve listed the contact details in a table below.

Remember to specify whether you’re planning to buy an owner-occupied or an investment property, as this will affect the stamp duty rate you are charged.

Let’s break down the concessions state by state

New South Wales

In June, 2017, the NSW government passed a bill that made first home buyers in that state exempt from paying stamp duty on both new and existing homes worth up to $650,000. Stamp duty discounts may also apply to properties worth up to $800,000 as part of a major housing affordability package announced by Premier Gladys Berejiklian, to help first home buyers get a foot in the market.

In order to qualify for the first home buyer’s grant, at least one purchaser must occupy the home within 12 months of purchasing and they need to live in the home for a continuous period of at least 6 months.

Eligible purchasers buying a vacant block of residential land to build their home are also exempt from paying duty on vacant land in NSW valued up to $350,000, and receive concessions for vacant land valued between $350,000 and $450,000.

Victoria

If you are buying or building a new home valued up to $750,000 in Victoria, you may be eligible for a First Home Owner Grant (FHOG). If you are eligible for the FHOG and the home you are buying is in regional Victoria, you will receive $20,000. If the home is not in regional Victoria, the grant is $10,000.

You may be eligible for – and receive – more than one exemption, concession or reduction from stamp duty, otherwise known as land transfer duty, for your property in Victoria.

The first home buyer duty exemption or concession is a one-off duty exemption for a principle place of residence (PPR) valued up to $600,000, or a concession for a PPR with a dutiable value from $600,001 to $750,000. Victoria also has an off-the-plan concession, a pensioner concession for a new or established home valued up to $750,000, and a young farmer’s exemption/concession – a one-off duty exemption/concession for young farmers buying their first farmland property.

Australian Capital Territory

The Home Buyer Concession Scheme (HBCS) is an ACT Government initiative to help people purchase a home or residential land by charging stamp duty or conveyancing duty at a concessional rate. To claim the HBCS, the value of a new home must be more than $470,000 but less than $607,000. To be eligible, vacant land must be purchased for more than $280,000 but less than $323,300. For more values, see the tables here.

Northern Territory

From 1 September 2016, the Northern Territory Government introduced increased stamp duty assistance for first home buyers who purchase an established home in the Northern Territory up to the value of $650,000.

The First Home Owner Discount (FHOD) is a concession on the initial $500,000 value of the home, which equates to stamp duty savings of up to $23,928.60. Until 31 August 2018, recipients of the FHOD are also entitled to a $10,000 Home Renovation Package.

First home buyers that are building or acquiring a new home are not entitled to the FHOD, however may be eligible for the $26,000 First Home Owner Grant (FHOG) and the territory also has what’s called the stamp duty Principal Place of Residence Rebate or the Senior, Pensioner and Carer Concession. (Where an applicant is eligible for more than one home incentive concession or grant, applicants will receive the highest grant or concession.)

Western Australia

In Western Australia, eligible first home buyers who wish to buy or build a new home may apply for a grant of up to $10,000 towards the purchase. The grant has geographically determined caps on the total value of the home; residence requirements; and eligibility criteria for applicants. When a home buyer is eligible for the First Home Owner Grant, a concessional rate of transfer duty will apply if the value of the dutiable property is below certain thresholds.

South Australia

In South Australia, if you are purchasing a new or substantially refurbished apartment you may be eligible for an off-the-plan stamp duty concession of up to $21,330 (capped at stamp duty payable on a $500,000 apartment), if your contract to purchase was entered into between 31 May 2012 and 30 June 2018. The concession is in addition to the FHOG.

A partial stamp duty concession is available for off-the-plan apartments purchased pursuant to qualifying off-the-plan contracts entered into between 1 July 2014 to 30 June 2018 (both dates inclusive).

Queensland

In Queensland, no transfer duty is payable when a first home concession is claimed on a home valued $500,000 or less.

Tasmania

Transfers between partners in a marriage, significant relationship, or caring relationship are currently exempt from duty in Tasmania.

How uno’s stamp duty calculator works

uno’s calculator accounts for each state’s concessions and grants. uno customers can rely on uno to update the calculator each time the government announces a new concession or amends a current one. For example, when the NSW state government announced in May 2017 that it was adding a first home buyer’s stamp duty concession on new and existing homes worth up to $650,000, uno updated its calculator so that it was ready to go on July 1, when the changes were implemented.

Let’s look at the stamp duty calculated by uno for a first home buyer looking to purchase a new home valued at $500,000, in each state and territory – and compare owner occupied taxes with the stamp duty an investor will pay.

What to do next

To make things easier for our customers, we have linked our stamp duty calculator to our funds required calculator, so you can find out how much deposit you have left once stamp duty is accounted for, and how much you will need to borrow.

What other fees are associated with stamp duty?

As well as the stamp duty fee itself, you’ll have to pay a transfer fee and a mortgage registration fee. The transfer fee is usually around $200-$300 and the mortgage registration fee around $100-$150.

When and how is stamp duty actually paid?

Once you’ve bought a house, stamp duty must be paid within three months of the date of exchange of contracts to avoid interest – or within 30 days of the property settlement. Your lawyer will assist you in arranging for it to be paid or you can pay it directly to the office of revenue in the state where you’ve purchased.

If you are purchasing property off the plan, stamp duty must be paid within three months from the date of:

- completion of the agreement; or

- the assignment of the whole or any part of the purchaser’s interest under the agreement; or

- the expiration of 12 months after the date of the agreement, whichever occurs first.

Most states offer a number of ways to pay stamp duty, including BPAY, Electronic Funds Transfer (EFT), Overseas Electronic Funds Transfer (EFT), Mail and Advance payment options. The NSW Office of State Revenue, for example, accepts payment in person, via BPAY, Electronic Funds Transfer (EFT), mail or advance payment.

If the sale transfer is cancelled, can I apply for a refund?

If your sale transfer is rescinded, the transfer is no longer liable for duty. You can apply for a refund by completing a form on the state revenue website where you purchased the property.

What is stamp duty money used for?

Stamp duty is invested into the economy by the state and territory governments which collect it and added into all state government budgets which typically include sectors such as health, transport and roads, police, justice and emergency services.

Can I borrow to pay for stamp duty as part of my home loan?

No you can’t borrow for stamp duty as part of your home loan, however in order to pay stamp duty, you can subtract that amount from your deposit and borrow more from the lender to make up the lost part of your deposit. Keep in mind that in Australia, the majority of lenders require you to have saved 10% of the property’s value in order to be approved.

Use the uno funds required calculator to work out just how much you need to buy your house.

Will the government ever abolish stamp duty?

According to a recent Housing Australia Report released by CEDA, abolishing stamp duties and replacing them with a broad-based land tax would present a unique opportunity to reap multi-generational benefits by removing one of the financial barriers to downsizing and subsequently freeing up more housing space for young families.

However, such a move would impact adversely on state revenue flows so for now it looks like stamp duty is here to stay.

Who can I speak to to find out more?

Each state and territory has its own department responsible for administering taxes and duties. For more information contact your local state or territory government authority. We’ve listed them below.

You can also speak to a uno consultant who can help you understand this part of the home buying process and answer any other questions you may have.

Further reading about home loan and property topics

Getting more educated on home loans and key topics within the property buying and ownership journey makes a lot of sense. We have created this set of guides to address the main topics that UNO customers typically want to learn more about

Guide to buying your first home

https://unohomeloans.com.au/first-home-buyer/

Guide to buying your next home

https://unohomeloans.com.au/buying-a-house/

Guide on buying an investment property

https://unohomeloans.com.au/investing/

Start Online Application

Ready to Purchase or Refinance right now, then start online using the links below

Online Application for Purchase

https://app.unohomeloans.com.au/new-loan

Online Application for Refinance

https://app.unohomeloans.com.au/address