Meredith Williams

12th October 2022

The idea of refinancing your home loan can seem like a major hassle, but the truth of the matter is, sitting on your hands is costing you real money when it comes to your mortgage.

Imagine this: you and your friend *Jim lives next door to each other in homes located on the exact same street, and during a friendly afternoon BBQ you discover something shocking: his loan is cheaper than yours.

Substantially cheaper. In fact, even though you both have a similar property and the same home loan amount, he pays $150 per month less than you do.

What’s the difference between you and Jim?

A little bit of shopping around, a small pile of paperwork, and Jim’s dogged belief that he should never have to pay more for his loan than he needs to.

Is your current loan good value? Check your loanScore nowYou see, Jim keeps an eye on his interest rates, and six months ago he went through a home loan refinance so he could get a competitive mortgage deal. He now pays less interest than you, and has lower home loan repayments.

The idea of refinancing your home loan can seem like a major hassle, but the truth of the matter is, sitting on your hands is costing you real money when it comes to your mortgage.

In the last 18 months, if you haven’t either picked up the phone and asked your lender for an interest rate discount or refinanced your loan, you could be missing out on huge savings.

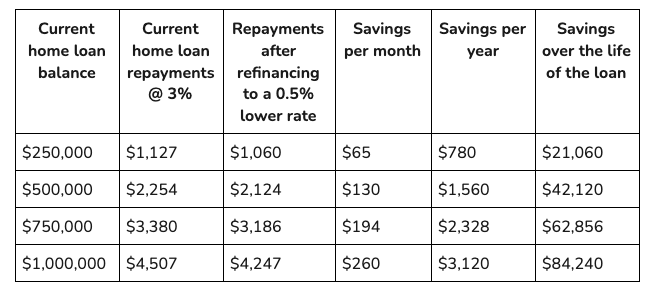

If you decide to refinance your home loan, you could enjoy big and immediate savings on your home loan repayments. We’ve used our home loan calculator to crunch the numbers – let’s look at a few examples:

In each of these examples, we assume a 30-year loan term and a mortgage that you’ve had for three years (so there are 27 years to go). Your new loan term stays the same at 27 years when you refinance (although you might have the choice to take out a fresh 30-year-term if you’d prefer). We’ve also assumed a principal and interest repayment.

It’s clear that the potential to save money through refinancing is available to anyone with a home loan, so what is stopping you from making the switch? A cheaper home loan might be no further than a quick phone call or click of the mouse away.

To see how much you could save by refinancing your home loan, check out loanScore, our mortgage busting refinancing calculator so we can get you started on a better home loan deal today.

Book in a quick call with our customer care team.

* Jim is an entirely fictional character. Don’t blame poor Jim if you’re paying too much for your home loan – instead, enquire about refinancing today.

Photo credit: Blog Next Door