Articles

UNO has one of the most comprehensive set of articles and guides to help you self learn on any topic related to property or home loans. We continuously update this content. Use the links below to narrow your search to a specific category of interest

- Articles

- Investing

Rentvesting Australia: the property strategy that could help you own a home sooner. Everything you need to know.

By Jordan White, June 27th, 2023

- Customer Stories

- Articles

How UNO helped Aussie expat Trent navigate buying an investment property from abroad

By Jordan White, May 27th, 2023

- Investing

- Articles

- Buying

By Vincent Turner, May 10th, 2023

- Articles

- Guides

- Buying

NSW first home buyer concessions: your ultimate guide to first home owners grants, land tax, stamp duty exemptions, first home buyer choice, and more.

By Jordan White, March 27th, 2023

- Articles

- Buying

By Janu Dhayanathan, March 6th, 2023

- Articles

- Investing

Capital Gains Tax (CGT) is a key consideration for property investors. But what exactly is it, and how can you reduce the amount you need to pay?

By Jordan White, March 3rd, 2023

- Articles

- Investing

UNO's guide to SMSF investment properties

By Jordan White, March 2nd, 2023

- Buying

- Articles

NSW new land tax vs stamp duty scheme - which is better?

By Jordan White, February 9th, 2023

- Articles

- Refinancing

Whether refinancing or taking out a home loan for the first time, acquiring a competitive rate could save you thousands of dollars. But should you go fixed, variable, or even a combination of the two?

By Danny Buckingham, January 23rd, 2023

- Articles

- Buying

Thinking about buying or selling a property off-market? Off-market properties are properties for sale that aren’t advertised to the public.

By Jordan White, January 20th, 2023

- Articles

- Buying

NZ Citizens can use KiwiSaver to buy a first home, but what about Australian property? Here's everything you need to know

By Jordan White, January 13th, 2023

- Articles

- Finance

- Property

- Investing

Becoming a landlord can help you earn income to repay your investment home loan, however many new landlords miss out on the tax deductions they can claim.

By Alexi Neocleous, January 9th, 2023

- Articles

- Guides

- Buying

Are you a New Zealander thinking about buying property across the ditch? Whether investing in Australian property from New Zealand or buying a new home to move to Australia, both are possible.

By Jordan White, December 1st, 2022

- Articles

Home loans from digital lenders are a popular option for home buyers looking for an alternative to traditional banks.

By Meredith Williams, October 17th, 2022

- Articles

- Buying

- Customer Stories

Victorian mother-of-two, Megan, and her husband, Chris, recently achieved financial freedom, paying off their mortgage at the age of 35 – just 13 years after buying their home.

By Hannah Tattersall, October 17th, 2022

- Covid-19 Support

- Articles

The owners of investment homes and apartments are potentially facing a double whammy from the coronavirus crisis. Not only are their tenants possibly facing hardship, affecting their ability to meet rent payments, investors’ themselves may face income declines thanks to the crisis.

- Articles

Australia’s economic chief is encouraging home mortgage holders to ask their bank for a better home loan deal or find a new bank. In a recent speech, Reserve Bank of Australia governor Philip Lowe said he’s very pleased to see that more people are switching banks to get lower mortgage interest rates.

By Meredith Williams, October 17th, 2022

- Articles

A part-time job won’t preclude you from getting a home loan. You’ll just need to meet some specific criteria. Find out how lenders look at people working part-time and what you can do to improve your chances of getting a loan.

By Alexi Neocleous, October 17th, 2022

- Articles

- Finance

Too many credit enquiries could impact your credit score and prevent you getting approved for a home loan product.

By Caroline Roberts, October 17th, 2022

- Articles

- Finance

You don’t need to struggle along on your own to save a deposit for a home loan. A guarantor can grease the wheels. You could even get a 105% home loan in the right circumstances.

By Alexi Neocleous, October 17th, 2022

- Articles

Calculate the benefit of a principal and interest loan over an interest-only loan for your investment property.

By Vincent Turner, October 17th, 2022

- Articles

Bad credit affects more than the irresponsible. Bad credit can happen to anyone. Here’s how bad credit scores work, and how your score can affect your property purchase.

By Alexi Neocleous, October 17th, 2022

- Articles

- Finance

UNO fields questions about the First Home Owners Grant on a daily basis. Here, we break down the six most common questions we get asked, and answer them for you.

By Chris Niesche, October 17th, 2022

- Covid-19 Support

- Articles

The idea of a mortgage holiday might sound attractive – who wouldn’t like a break from paying off their home loan? But this could turn into a sticky situation.

By Meredith Williams, October 17th, 2022

- Articles

It’s bad news for the homeowner when a property enters foreclosure. However, it could mean good news for you, if you can bag a bargain. But there are some things you must keep in mind.

By Alexi Neocleous, October 17th, 2022

- Articles

- Finance

About to take the plunge on a home loan? This handy guide helps you prepare an application without destroying your credit score

By Helen McMurdo, October 17th, 2022

- Articles

- FAQs

An Automated Valuation Model (AVM) is an algorithm which uses statistical methods to value properties. An AVM is an estimate and should not be confused with a valuation from a registered property valuer.

By UNO home loans, October 17th, 2022

- Finance

- Articles

If you’re looking for flexibility and seeking to minimise the risk of your repayments rising exponentially, then splitting your loan into part fixed and part variable portions may help you achieve just that.

By UNO home loans, October 17th, 2022

- Articles

- Finance

- Lifestyle

Double-crossing mortgage holders – that is, those who shop around for a better deal – pay 30 basis points less on their home loan than those who stick to their current interest rate, uno Home Loans has found.

By Hannah Tattersall, October 17th, 2022

- Articles

- Customer Stories

An insurance payout at 11 landed Leonie Fitzgerald enough money to go halves in her first property at age 18. But it wasn’t all smooth sailing from there. In the first of UNO’s Great Australian Dream series, we chat to the investment strategist about her property highs and lows.

By Hannah Tattersall, October 17th, 2022

- Articles

- Property

What are the benefits of taking out a variable rate loan? What are the downsides? How do you calculate your monthly repayments? Here you’ll find out everything you need to know about variable rate home loans.

By Alexi Neocleous, October 17th, 2022

- Articles

- Guides

If you're looking to buy a property our comprehensive guide can help answer your questions and we can also help you secure the right home loan for you. Win!

By UNO home loans, October 17th, 2022

- Articles

- FAQs

Yes, uno allows self-employed borrowers the opportunity to choose the best home loan for their needs.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

uno is a service that allows you to compare home loans intelligently, taking into account your loan amount and personal preferences, as well as complicated interest rate discount structures and mortgage broker strategies

By UNO home loans, October 14th, 2022

- Finance

- Articles

A new report from UNO Home Loans shows Australians are wasting an estimated $4.2 billion annually on non competitive interest rates and ineffective savings tactics.

By Hannah Tattersall, October 14th, 2022

- Articles

- FAQs

Yes, uno gives first home buyers all the information they need to find the best home loan available.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

No, uno’s service is free of charge.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

Yes, uno has an Australian Credit Licence through ASIC and all of our loan writers are accredited under that licence.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

We will need certain documents from you to recommend home loans and complete your application, including pay slips, bank statements and tax return documents.

By UNO home loans, October 14th, 2022

- FAQs

- Articles

An Expert Review is required so that we can help you choose the a home loan that meets your needs. A review gives our experts the chance to analyse your home loan shortlist and financial situation and recommend products that suit your circumstances.

By UNO home loans, October 14th, 2022

- Articles

No, uno’s service is free of charge.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

Traditional mortgage brokers use a set of tools that help them arrive at the home loan they recommend for you, but you often have no idea how or why they came to recommend it.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

Yes, uno could help you find a better deal and save money by giving you the power to compare a range of options from major and specialist lenders across Australia.

By UNO home loans, October 14th, 2022

- Finance

- Articles

The result has now stayed the same since mid-2016, but speculation is mounting that the RBA will make its big move later this year. The hotly debated question is whether the next move will be a cut or an increase.

By Hannah Tattersall, October 14th, 2022

- Finance

- Articles

Celebrating Melbourne Cup? But wait, there’s more reason to celebrate: the RBA announces that the cash rate remains at 1.50% and the NSW Government overhauls residential stamp duty.

By Hannah Tattersall, October 14th, 2022

- Articles

- Finance

Lenders ask for proof of your income as part of your home loan application. In cases where your payslips and tax returns don’t offer enough information, you may also need to provide a letter of employment.

By Alexi Neocleous, October 14th, 2022

- Finance

- Articles

A recent uno survey found that 77% of mortgage holders view refinancing as a hassle. uno’s platform removes the hassle and lets you search for a better deal on your mobile phone in 10 minutes.

By Vincent Turner, October 14th, 2022

- Articles

- Finance

With so many home loan products available, it’s often difficult to choose the best one. While mortgage brokers can help, there are several steps you can take yourself to ensure you get a good product.

By Alexi Neocleous, October 14th, 2022

- Articles

- Finance

A home loan can be a virtually watertight mechanism to grow your wealth – or like a leaky bucket, with much of your hard-earned money trickling into the lender’s profit pool. Here are three mortgage features that make the difference.

By Nicole Pedersen-McKinnon, October 14th, 2022

- Articles

- Property

Melbourne artist and mother-of-two, Marnie Higgs needs no further evidence of the power of the sun on her family finances. Higgs and her husband decided to install solar panels on their family home in Blackburn South in January.

By Peter Gearin, October 14th, 2022

- Finance

- Articles

It’s been a busy week with the first of the big banks, Westpac, opting to hike rates, inciting speculation others will follow. We break down what it means for you.

By Hannah Tattersall, October 14th, 2022

- Finance

- Articles

Is the Coq au Vin pasture-raised? Just as the ethical food movement drastically changed the way we dine at restaurants, a financial startup is challenging the way Australians think about their super fund.

By Hannah Tattersall, October 14th, 2022

- Finance

- Articles

Our research shows 52% of Australians aren’t confident they’ve found the best home loan deal for them. Could you be paying too much on your mortgage?

By Hannah Tattersall, October 14th, 2022

- Articles

Saving for a deposit can be extremely difficult. In some cases you can, however, secure a loan with no deposit at all. Here’s how.

By Alexi Neocleous, October 14th, 2022

- Finance

- Articles

Sydneysiders Sally and James recently found themselves in a pretty exciting situation. They received a windfall which was enough to pay off their mortgage. The question was, should they do it – or go on that holiday they’d been dreaming about?

By Donna Webeck, October 14th, 2022

- Articles

- Property

- Lifestyle

To stay or not to stay. That is the question many homeowners encounter as their lives change and families expand. It’s never an easy choice to make. Here, we outline the pros and cons for staying and renovating, or selling and relocating.

By Donna Webeck, October 14th, 2022

- Articles

- Property

There are a lot frustrated buyers out there, overwhelmed by selling agents’ tactics and sick of underquoting. Buyer’s agents exist to help these people.

By Peter Gearin, October 14th, 2022

- Articles

- Finance

- Lifestyle

Families, especially in Sydney and Melbourne, have found themselves compromised by the skyrocketing value of surrounding properties. But owners looking to upgrade to their dream home in a rising market have a few options.

By Peter Gearin, October 14th, 2022

- Articles

- Finance

A family trust might make it possible for you to invest in real estate. They are complex financial structures, so you need to know what they are and how you can use them.

By Alexi Neocleous, October 13th, 2022

- Articles

- Finance

- Property

Tenants have more demands than ever before. They want to ensure they receive as much as possible for the money they pay. As an investor, you’ll need to meet these demands if you want to increase how much you earn from rent payments.

- Articles

- Guides

What is strata, what does it cover, and are they a good investment? These pros and cons will help you make a better decision when investing.

By UNO home loans, October 13th, 2022

- Articles

- Customer Stories

From a 1970’s two-bedder south of Sydney to an enviable family pad in Coffs Harbour, Cath Fowler’s smart property choices have left her mortgage-free at 34. Here’s how she did it.

By Cath Fowler, October 13th, 2022

- Articles

Did you know teachers can get better mortgage rates? Banks and home lenders are keen to offer teachers home and investment loans. Read more at UNO.

By Meredith Williams, October 13th, 2022

- Property

- Investing

- Articles

With its renowned sporting and festival culture, trendy cafés and great value property, Melbourne might very well be an investor’s dream.

By Mark Ribarsky, October 13th, 2022

- Articles

- Finance

- Property

The economic damage wrought by the COVID-19 crisis has forced lenders to rethink how much money they will lend for a property purchase and to whom.

By Vincent Turner, October 13th, 2022

- Finance

- Articles

The thing about loyalty is, it’s not always rewarded.

By Anthony Justice, October 13th, 2022

- Articles

If you're one of the tens of thousands of Aussies who fixed their rates a few years ago when rates were 'never going to be lower' then you're probably one of the tens of thousands of people who are now frustrated to see rates in the mid 2s when you're probably in the high

By Meredith Williams, October 13th, 2022

- Articles

- Finance

- Lifestyle

Young people can go out and enjoy a cup of coffee and smashed avocado for brunch, and still afford to buy a house. It just needs to be a purposeful decision, says a property expert.

By Sarah Megginson, October 13th, 2022

- Articles

If you’re one of the tens of thousands of Aussies who fixed their rates a few years ago when rates were ‘never going to be lower’, then you’re probably one of the tens of thousands of people who are now frustrated to see rates in the mid 2s when you’re probably in the high 3s or even 4s. It’s time to break up with your fixed rate home loan.

By Meredith Williams, October 13th, 2022

- Finance

- Articles

Living expenses are a big factor when it comes to applying for a home loan. Your lender will want to know how much you spend each week on groceries, takeaway, coffee and the gym. But have you accounted for everything? Many people don’t realise what else is included on the list of living expenses.

By Hannah Tattersall, October 13th, 2022

- Articles

- Finance

There’s a trifecta happening right now in home loans. With interest rates low, property prices cooling and seven weeks to settle before Christmas, this unique moment in time would have bookies in a frenzy.

By Hannah Tattersall, October 13th, 2022

- Articles

- FAQs

The simplest way to quickly pay down your home loan is to allocate as much income as you can to your mortgage. We've listed 3 steps to take first.

By UNO home loans, October 13th, 2022

- Articles

- Guides

Once a property has been passed-in, everything changes. It becomes a battle of wills. Learn how you can negotiate your way to the best price.

By Peter Gearin, October 13th, 2022

- Articles

- Property

We asked our team of brokers to break down some of the most common (and misunderstood) terms you’ll hear when applying for a home loan.

By Meredith Williams, October 13th, 2022

- Articles

- Finance

By calculating depreciation on your investment property, you may be able to claim an income tax deduction and lower your overall tax payment in a financial year.

By Caroline Roberts, October 13th, 2022

- Articles

- Finance

Saving for the deposit for a new home may be one of the hardest tasks you undertake. You need to save thousands of dollars before you can get a home loan. These tips will help you get there faster.

By Alexi Neocleous, October 13th, 2022

- Articles

- Customer Stories

Robyn Cott had a retirement plan – she would rent out her investment property and pay off her refinanced mortgages quickly while earning two income streams.

By Peter Gearin, October 13th, 2022

- Articles

- Finance

Most lenders don’t offer no-deposit home loans anymore – the risk attached to them is too high. However, with some lenders you can still access products with a loan-to-value ratio (LVR) of 95%.

By Caroline Roberts, October 13th, 2022

- Articles

- Guides

When you refinance your loan to consolidate debt, it’s usually to save money. You may be paying off a personal loan, car loan and multiple credit cards on top of your home loan – and paying different rates of interest on all of them.

By UNO home loans, October 13th, 2022

- Articles

- Finance

You may have heard of people using the equity they have in their home to fund their investments. Here we’ll look at what equity is and how you can use it.

By Alexi Neocleous, October 13th, 2022

- Articles

- Finance

Why do lenders have to offer comparison rates for their home loans? Let’s untangle the legalities so you understand what a comparison rate is and why you should expect one from your lender.

By Alexi Neocleous, October 13th, 2022

- Articles

Understanding small home loan lenders and other types of institutions can help you gain an insight to their benefits and levels of risk. Find out more.

By UNO home loans, October 13th, 2022

- Articles

- Guides

There are a lot of frustrated buyers out there, overwhelmed by selling agents’ tactics and sick of underquoting. Buyer’s agents exist to help these people.

By UNO home loans, October 13th, 2022

- Articles

- Property

It’s been a year of peaks and troughs for the Australian property market and today’s decision by the RBA to keep rates on hold at 1.50% is borne of a range of factors likely to shape the outcome of 2018.

By Hannah Tattersall, October 13th, 2022

- Articles

- Finance

- Lifestyle

Forty per cent of Aussie mortgage holders don’t know the interest rate they’re paying on their home loan and are likely to be paying off their mortgage at a much higher rate than they should be.

By Hannah Tattersall, October 13th, 2022

- Articles

- Finance

Lenders mortgage insurance comes to your rescue when you can’t make a large deposit. It can help you to buy your first home faster.

By Alexi Neocleous, October 13th, 2022

- Articles

- FAQs

How much a lender will let you borrow varies from bank to bank, but it will broadly depend on your income, living expenses, existing loan repayments as well as a few other variables.

By UNO home loans, October 13th, 2022

- Articles

- Finance

We’d all like more cash to put towards our home loan or house deposit. Here are five money-saving apps to help you save on a day-to-day basis.

By Kris Davant, October 13th, 2022

- Articles

- Property

The idea of moving to greener pastures and setting up a hobby farm may appeal to you. However, it’s often difficult to finance the venture. You may find that many lenders won’t offer you a standard home loan for your hobby farm.

By Alexi Neocleous, October 13th, 2022

- Articles

- Customer Stories

Like many parents, Christine Freney wanted to help her kids on the path to home ownership. But it’s never been more difficult for young people to secure an affordable home. Find out how UNO helped Christine and her son secure the perfect loan – together.

By Peter Gearin, October 13th, 2022

- Lifestyle

- Articles

The Block winners Shannon and Simon Vos know a great deal about homes and renovating but admitted they weren’t so savvy when it came to home loans.

By Hannah Tattersall, October 13th, 2022

- Articles

You may have multiple options available to you when looking for a home loan – which can make it difficult to choose the right one.

By Alexi Neocleous, October 13th, 2022

- Articles

- Covid-19 Support

- Finance

If you are suffering financial hardship as a result of the coronavirus pandemic you are allowed to withdraw $10,000 before June 30 and another $10,000 between July 1 and September 24 out of your superannuation account to help you through the hard times.

By Meredith Williams, October 13th, 2022

- Articles

- Lifestyle

When it comes to home ownership, we hear a lot about Millennials unable to save for a house deposit and spending their days gorging on avocados. But some Baby Boomers don’t have it so easy either.

By Hannah Tattersall, October 13th, 2022

- Articles

- Finance

Changing interest rates can come back to hurt you if you have a standard variable rate home loan. A split mortgage offers a middle-ground, but you need to keep a few things in mind before applying for one.

By Caroline Roberts, October 13th, 2022

- Articles

- Finance

- Property

If you’re the sole employee of your own company, you can apply for a low doc home loan. To assess your finances, lenders will ask you to provide your ABN.

By Alexi Neocleous, October 13th, 2022

- Articles

- Guides

When you refinance your home loan, it’s often to get a better interest rate than you have on your current home loan, in order to pay off your mortgage faster like a pro. This will save money in the long term.

By UNO home loans, October 13th, 2022

- Articles

- Guides

We've got the tips and tricks to help you win at auction. Visit our official site and learn more about how to bid at auction.

By UNO home loans, October 13th, 2022

- Articles

- Guides

Buying a foreclosed property is not the same as buying a regular property. These 5 easy tips will help you win at buying properties at low prices.

By UNO home loans, October 13th, 2022

- Articles

- Property

Buying a first home is a very personal decision, because everyone’s tastes and needs are different.

By Meredith Williams, October 13th, 2022

- Articles

- Finance

Are you on an interest-only loan? While it’s generally investors who are, 1 in 4 IO loans are actually taken out by owner-occupiers. With 200,000 IO loans set to expire in the next few years, these people need to consider their options.

By Hannah Tattersall, October 13th, 2022

- Articles

- Finance

A changing industry presents opportunities to review the way brokers deliver ongoing value to customers, says UNO CEO Anthony Justice.

By Anthony Justice, October 13th, 2022

- Articles

- Customer Stories

UNO Home Loans can help any first home buyer, such as 34-year-old David from NSW, get a loan that suits individual needs. See our mortgage calculator.

By Peter Gearin, October 13th, 2022

- Articles

With our states in and out of lockdown, and many of us spending more time at home, Aussies have been rushing to 'spring clean' their home loan. Why? Because Aussies are realising that staying just a little more active on their home loan can mean some seriously big savings.

By Meredith Williams, October 13th, 2022

- Articles

Engaging a mortgage broker to help with getting your home loan can make a lot of sense. But how do mortgage brokers work? Click to learn more.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

You can upload documents through the uno website. Either take a photo or scan the documents in your computer or smartphone.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

You can invite your partner to share your uno account within the Settings section of your uno dashboard, when you’re logged in.

By UNO home loans, October 13th, 2022

- Articles

- Guides

We provide information to the big question everyone's asking - should I buy or rent? Our pros and cons will help you determine which option is better and cheaper. Win!

By UNO home loans, October 13th, 2022

- Customer Stories

- Articles

“Oftentimes our conveyancer was atrocious with her availability and guiding us as first home owners through the process, so UNO would act in that role.”

By Hannah Tattersall, October 13th, 2022

- Articles

- FAQs

Want to know how long refinancing your home will take? Curious to know if you could get it done by the end of 2020? Find out more at the UNO website.

By UNO home loans, October 13th, 2022

- Articles

- Finance

To build your own property, you’ll usually have to apply for a construction loan, which differs to a regular home loan. Most lenders release the money in instalments, relating to each stage of construction.

By Alexi Neocleous, October 13th, 2022

- Articles

- Investing

- Property

- Finance

Will investors continue to slay in 2018 or is it finally the time for first home buyers to capture a piece of the property market?

By Cath Fowler, October 13th, 2022

- Covid-19 Support

- Articles

As the COVID-19 crisis subdues the economy, many people are losing their jobs or having their hours and incomes cut. Fortunately, the government is offering financial assistance to help people through the tough times. Here’s what you need to know.

By Meredith Williams, October 13th, 2022

- Articles

- Finance

Most Australians think they’ll own their homes outright by the time they retire, but a new report details how mortgage debt among older Australians blew out by 600% between 1987 and 2015.

By Hannah Tattersall, October 13th, 2022

- Articles

- Finance

Your home loan is likely going to be the biggest debt you have in your life. Getting it repaid quickly frees up your money for other things.

By Meredith Williams, October 13th, 2022

- Articles

On the face of it buying a property at auction looks simple - the property is sold to the highest bidder. But as many stressed out property buyers will tell you, its more complicated than it looks. If you want to be the successful bidder and secure your ideal home or investment property, you need

By Meredith Williams, October 13th, 2022

- Articles

Fintech companies are leading the digital revolution. From splitting the bill with friends to buying your first home, fintechs are disrupting traditional models to bring customers a better user experience. Here are six local disruptors to look out for.

By Rakhee Ghelani, October 13th, 2022

- Articles

- FAQs

The simplest way to minimise interest repayments over the life of your loan is to allocate as much income as you can to your mortgage while resisting the urge to reborrow anything through a redraw facility.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

Australian credit history files are maintained by VEDA. On request, VEDA will provide a copy of your credit history to yourself or any third party you authorise.

By UNO home loans, October 13th, 2022

- Articles

- Finance

A bad credit report could prevent you from accessing home loan products. All is not lost though, as there are several things you can do to repair your credit.

By Caroline Roberts, October 13th, 2022

- Articles

- FAQs

You can write a note along side a document to let us know if a document should be removed and we’ll do that for you.

By UNO home loans, October 13th, 2022

- Articles

- Property

Most lenders won’t let you take a home loan on a display home. Still, you can finance this type of property in several ways.

By Alexi Neocleous, October 13th, 2022

- Articles

- Finance

Working with mortgage brokers offers you access to an array of home loan products and lenders. However, you may be wary of the fees your broker charges. This breakdown will tell you everything you need to know.

By Alexi Neocleous, October 13th, 2022

- Articles

- Guides

Are you a first home buyer and have no idea where to begin? Our guide will show you all the basic information you need to know and kickstart your home loan journey.

By UNO home loans, October 13th, 2022

- Articles

- Lifestyle

With restrictions easing, we are slowly seeing the return of potential buyers attending live auctions and viewings which means there is more competition when it comes to selling your home. test

By Meredith Williams, October 13th, 2022

- Articles

- Finance

Lenders may let you borrow money in a different currency, but only under certain conditions. Find out why.

By Alexi Neocleous, October 13th, 2022

- Articles

- Finance

- Property

It‘s a question all borrowers ask themselves: How can I get the best possible deal on my home loan?

By Helen McMurdo, October 13th, 2022

- Articles

- Guides

Embrace the feeling of buying your perfect home when you follow our 5 easy steps. Discover more at our official site.

By UNO home loans, October 13th, 2022

- Covid-19 Support

- Articles

A number of home loan lenders have announced financial relief packages to assist those affected by COVID-19. We have compiled a list of lenders, contact numbers and links to their websites to help you get in touch quickly and get the support you need.

By Meredith Williams, October 13th, 2022

- Articles

- Lifestyle

The COVID-19 crisis hit Jeremy Fleming and his company Stagekings harder and faster than most other businesses.

By Meredith Williams, October 13th, 2022

- Articles

The RBA’s recent commentary is a sobering bulletin for all property investors

By Vincent Turner, October 13th, 2022

- Articles

- Property

Kit homes aren’t the same as regular new builds. Instead of building from scratch, you construct a kit home using prefabricated parts. However, many lenders are wary of kit homes and may not offer you the home loan product you want.

By Alexi Neocleous, October 13th, 2022

- Articles

- Property

Are you on a mission to buy property? Well get this in your ears, and turn up the volume - because The Floor Plan is about to make your weekends easier and your finances brighter. Listen for free here.

By Helen McMurdo, October 13th, 2022

- Articles

- Finance

Could you get a better mortgage deal and save a bunch of money without all the unnecessary hoopla? By refinancing, absolutely.

By Sonja Koremans, October 13th, 2022

- Articles

- Customer Stories

“All I was doing was servicing my old loan. I didn’t know I was allowed to use the equity to buy other things.”

By Hannah Tattersall, October 13th, 2022

- Articles

- Customer Stories

Andrew Niklaus, who has been deaf since birth, used UNO’s online chat function to find his ideal home loan. This is his story.

By Peter Gearin, October 13th, 2022

- Articles

Bridging loans allow you to own 2 properties at once – the home you just bought and the home you need to sell to pay for it. Learn how bridging loans work.

By Peter Gearin, October 13th, 2022

- Articles

Canny sports stars have turned their success into glass, steel and timber. Explore the impressive property portfolios of Australia's sporting stars.

By Peter Gearin, October 12th, 2022

- Articles

With Australia's average house price ever rising, it may surprise you what $775,000 buys in Australia and around the world. Click to find out.

By Peter Gearin, October 12th, 2022

- Articles

- Property

When it comes to building your own home, what sort of loan do you need? And will it be any more difficult to get than a home loan for a property already built? Let’s find out.

- Articles

Run down and unloved properties aren't always appealing; but these renovation specials can offer great value. Click and learn how to spot the hidden gems.

By Peter Gearin, October 12th, 2022

- Articles

- Finance

- Property

Many people don’t think of their homes as an opportunity to make money: they’re satisfied paying off their loans and living in the property. But what happens if you do want to take on a tenant?

By Alexi Neocleous, October 12th, 2022

- Articles

- Guides

The search for that perfect piece of real-estate can be exciting – but also insanely stressful. Even before you start house hunting, there are multiple things to consider.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, we will do our best to help you organise finance to ease the stress in that anxious period between buying and selling a home.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Use UNO’s Stamp Duty Calculator for a guide on stamp duty costs.

By UNO home loans, October 12th, 2022

- Articles

- Guides

FHOG, or the First Home Owner Grant, is a state government initiative developed to assist people in purchasing their first residential property.

By UNO home loans, October 12th, 2022

- Articles

- Finance

While other events this week may have blindsided us (Super Bowl, anyone?), the RBA’s decision to keep rates on hold did not. On top of today’s announcement, here are some other signifiers that might suggest it’s time to check your home loan rate.

By Hannah Tattersall, October 12th, 2022

- Articles

- FAQs

You can book in a time using our online booking link or email us

By UNO home loans, October 12th, 2022

- Articles

- Finance

Running a small business is difficult enough without having to chase up payments or worry about contract terms. Colin Porter’s CreditorWatch helps business owners improve their cash flow without having to pick up the phone and chase idle contractors.

By Rakhee Ghelani, October 12th, 2022

- Articles

- FAQs

We can help if you need an urgent approval. Contact us immediately on 133 866 or through online chat.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Simply let us know by calling our support line on 133 866, or through online chat.

By UNO home loans, October 12th, 2022

- Articles

The Mortgage and Finance Association of Australia, which represents professional finance brokers.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, but only in accordance with our privacy policy, which you can read here.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

We may contact you through push notifications, email or phone at important milestones, such as when your loan is approved.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, you can speak with our support team from 8am to 10pm (AEST) Monday to Friday, and 8am to 8pm on the weekend. Simply call our support line on 133 866 or request a call back.

By UNO home loans, October 12th, 2022

- Articles

- Guides

One of the major hurdles to buying property in Australia for first home buyers is the cost of stamp duty, which, depending on where you’re buying, often seems almost as much as the amount you’ll need to save for the deposit.

By UNO home loans, October 12th, 2022

- Articles

- Covid-19 Support

As a first home buyer, you might not be able to get out to open homes and auctions at the moment, but that doesn’t mean you shouldn’t be doing all you can to preserve the home deposit you’ve worked so hard to save.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

It takes the average household nine years to save a 20% deposit for their first home, making this one of the biggest barriers to homeownership. We explore the recently announced First Home Loan Deposit Scheme and how it can see you moving into your first home faster.

By Cath Fowler, October 12th, 2022

- Articles

- Property

Despite battling some serious health issues, Tracy Bell paid off her mortgage with sacrifice, patience and some careful planning. She shares her story with Donna Webeck.

- Articles

Record numbers of Australian homeowners are rushing to refinance their mortgages to take advantage of steep drops in interest rates over the past few months. In May, a record 21,000 Australian homeowners refinanced $10 billion worth of home loans by moving to different lenders.

By Meredith Williams, October 12th, 2022

- Articles

Here is our cheat sheet to help you get started on some of those tasks and finally get some of those pesky jobs you’ve been putting off, done — and maybe even help you save a few bucks in the process.

By Meredith Williams, October 12th, 2022

- Articles

In the market for a new home? You probably feel as though you could use all the help you can get. Find out what the best real estate apps are.

By Peter Gearin, October 12th, 2022

- Covid-19 Support

- Articles

It’s easy to get caught up in the doom and gloom of the COVID-19 crisis. But for those who are looking to save money on their home loan, invest in a property, or even buy their first home – there are good reasons to act now.

By Meredith Williams, October 12th, 2022

- Articles

The idea of refinancing your home loan can seem like a major hassle, but the truth of the matter is, sitting on your hands is costing you real money when it comes to your mortgage.

By Meredith Williams, October 12th, 2022

- Articles

For Aussies, the worst of the coronavirus looks like it might be passing, but its economic repercussions are still being felt, including in the property sector. Here’s what you need to know about investing in property post-coronavirus.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

Scott Pape, aka the ‘Barefoot Investor’ recently sent an email to his tribe with the subject line: “The 4 cheapest home loans on the market in June.”

By Justin Bohlmann, October 12th, 2022

- Customer Stories

- Articles

Read how concreter Ken Smith consolidated his loans and shaved $7000 off his mortgage.

By Peter Gearin, October 12th, 2022

- Articles

The home mortgage is moving into the digital age and has been sped up as a result of coronavirus and many borrowers will benefit from this with easier and more convenient loans and more borrowing options.

By Meredith Williams, October 12th, 2022

- Articles

Financial resilience is top of mind for most of us right now. You may be reviewing your expenses and thinking, how can I reduce my costs?

By Jessica Pilon-Summons, October 12th, 2022

- Articles

- FAQs

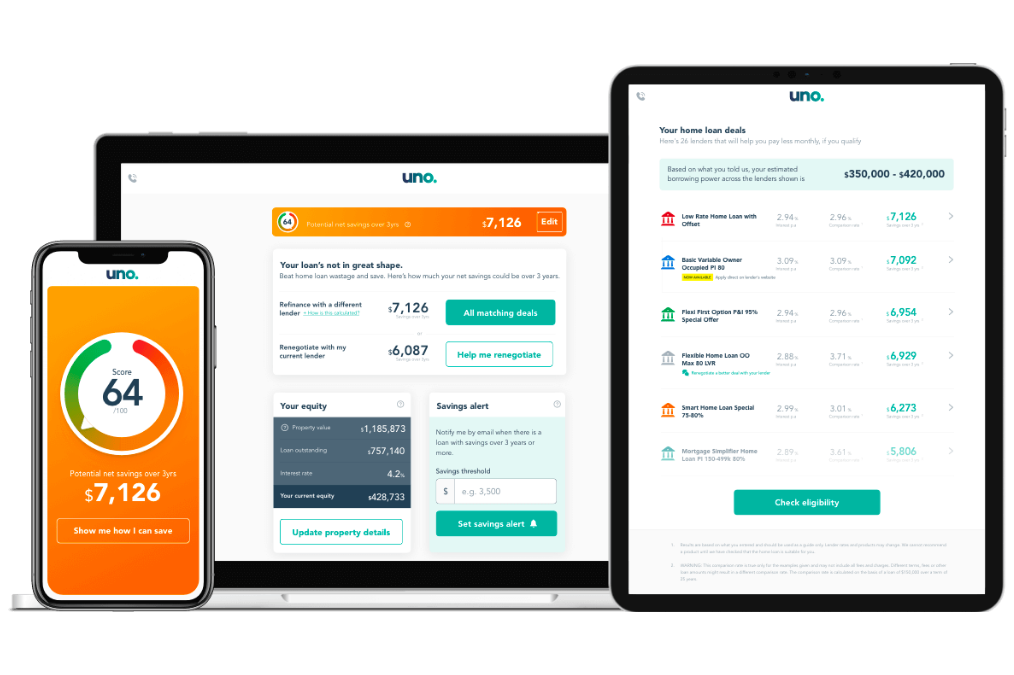

loanScore is a simple way of seeing if the home loan you have at the moment is a good deal or not. We want you to know whether you are getting a good deal based on your circumstances such as the value of your property, the preferences you have for your loan

By Meredith Williams, October 12th, 2022

- Articles

It's never a bad time to look at refinancing your home loan. However, the best time is when interest rates are at all-time lows. Learn about refinancing.

By Meredith Williams, October 12th, 2022

- Articles

Australians are on the whole a pretty health-conscious nation. Not just in the way we live and eat, but more so now as we all take steps to keep ourselves, our families and our loved ones safe and healthy during COVID-19.

By Meredith Williams, October 12th, 2022

- Articles

We can help you work out whether your current home loan deal is costing you too much in a moment – but first, here’s how much you could save.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

Living overseas can make getting a home loan more difficult. But all is not lost for expats. Many lenders offer loans to expats as long as they meet certain criteria.

By Alexi Neocleous, October 12th, 2022

- Articles

- Finance

The self-employed – or gig economy workers – often struggle to get home loans. However, mortgage brokers and lenders say there is no reason why they can’t secure finance.

By Chris Niesche, October 12th, 2022

- Articles

With our unique technology, UNO can proactively manage your home loan so you don't have to. Our customers get regular alerts and updates so they can see if they could be getting a better deal.

By Anthony Justice, October 12th, 2022

- Articles

Choosing the right builder can be the difference between a successful renovation and a failed one. Click to see what advice Adam Hobill has for renovators.

By Peter Gearin, October 12th, 2022

- Articles

Interest rates in Australia are at near historic lows - should you consider using a fixed rate home loan? Click and see what the experts have to say.

By Peter Gearin, October 12th, 2022

- Articles

- Covid-19 Support

In these unprecedented times, landlords are facing big changes in the market and many have seen an impact not only on the value of their property, but also on their rental income.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

- Property

Taking out a loan to cover the construction costs of your home can be very complex. There are a few important things you should sort out before applying for a loan.

By Alexi Neocleous, October 12th, 2022

- Finance

- Articles

Australians often call on mortgage brokers to help navigate the complexities of finding the right home loan. As an online mortgage broker, UNO helps buyers and refinancers find the best home loan for their situation. Here are six questions you should ask your mortgage broker so they can find the right deal for you.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

Lenders use your credit score to assess your mortgage application. Your credit score is based on your credit file and information you provide in your application. It will vary from lender to lender, according to their loan criteria.

By Caroline Roberts, October 12th, 2022

- Articles

- Finance

If you’re paying off more than the minimum repayments on your home loan, you may actually incur break costs fees from your bank. Here’s our guide to understanding and – ideally – minimising what you might need to pay with our break cost calculator.

By Meredith Williams, October 12th, 2022

- Articles

Ask any homeowner how long it took them to fill out their home loan or refinancing applications and, chances are, you’ll get an exasperated "12 hours" as a response – even when the reality is more like two hours.

By Meredith Williams, October 12th, 2022

- Articles

- Covid-19 Support

“Side hustles” have long been a way to diversify and compliment your primary income stream and many of us who have felt the financial squeeze of COVID-19 may have looked to side hustles to help make up for sudden short falls in income.

By Jessica Pilon-Summons, October 12th, 2022

- Customer Stories

- Articles

After plugging a few details into UNO’s loanScore tool, PJ discovered her home loan rate was almost two percentage points higher than others offered on UNO’s panel.

By Hannah Tattersall, October 12th, 2022

- Articles

- Finance

Have you thought about how prepared you are if the economy takes a downward swing? With these tips, you can help recession-proof your home and ensure changing economic fortunes don’t cause problems.

By Alexi Neocleous, October 12th, 2022

- Articles

- Finance

Before you apply for finance, the first thing you should do is to get your personal finances in check.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

Can’t be bothered switching? Think it’s too soon to refinance? Delve a little deeper and you’ll realise the potential savings are enormous, writes Nicole Pedersen-McKinnon.

By Nicole Pedersen-McKinnon, October 12th, 2022

- Articles

- Covid-19 Support

Along with help for people who have lost their jobs, the government is also paying cash to the self-employed whose incomes have dropped because of the coronavirus crisis.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

You can’t always get the amount of money you want when you apply for a home loan. Your lender takes a lot of things into account when working out your borrowing power.

By Alexi Neocleous, October 12th, 2022

- Articles

- Guides

Buying and selling a home can be a tedious process. We can help make this process easier by ensuring you know all the costs involved.

By UNO home loans, October 12th, 2022

- Articles

- Finance

To find out how to avoid over-committing to a huge mortgage, we’ve sourced tips from someone who’s served time on the other side of the fence – in some of Australia’s biggest banks.

By Hannah Tattersall, October 12th, 2022

- Articles

- Guides

There are investment property tax benefits in some situations. If you are going to invest, it is important to understand the laws and regulations so you can maximise your returns.

By UNO home loans, October 12th, 2022

- Articles

- Investing

But did you know that getting a mortgage or refinancing your home could soon be even easier thanks to planned changes in the credit laws? Here is what you need to know.

By Meredith Williams, October 12th, 2022

- Articles

- Guides

In order to assist first home buyers in cracking the property market, in the 2017–18 Federal Budget the Australian government introduced the The First Home Super Saver (FHSS) scheme.

By UNO home loans, October 12th, 2022

- Articles

- Finance

Interest-only home loans are a double-edged sword. On one hand, they allow you to pay less each month. On the other, they don’t dent your loan principal. Here, we look at interest-only loan extensions.

By Alexi Neocleous, October 12th, 2022

- Articles

In breaking news the RBA has announced that the cash rate will remain on hold at the historically low rate of 0.1%

By Meredith Williams, October 12th, 2022

- Articles

- Guides

When buying your first home, saving for a deposit can be super hard, particularly if you’re paying rent at the same time. Many young couples and singles choose to move back in with their parents for a few months while they save money, but this isn’t an option for everyone.

By UNO home loans, October 12th, 2022

- Finance

- Lifestyle

- Articles

Australians are wasting $1.8 billion a year on unused gym memberships and more than double that amount on suboptimal home loans.

By Hannah Tattersall, October 12th, 2022

- Articles

Could it be that you’re feeling a little beaten down by money worries? Financial stress can adversely impact your sleep, self-esteem and your energy levels so rather than spending money, here are our 5 of our favourite tips for financial self care.

By Meredith Williams, October 12th, 2022

- Articles

- Buying

- Property

- Guides

Owning your own home is a big dream that requires sacrifices. You’ll need to be smarter than ever with your money and pay your home loan on time. To help you, we’ve outlined the 10 steps you need to follow to become a homeowner.

By UNO home loans, October 12th, 2022

- Articles

- Finance

While buying a National Rental Affordability Scheme property comes with tax benefits, it can be difficult to finance the purchase with a home loan.

By Alexi Neocleous, October 12th, 2022

- Articles

- Finance

Even though mortgage regulators are cracking down on how much banks are lending, chances are they will still extend you too much, writes Nicole Pedersen-McKinnon.

By Nicole Pedersen-McKinnon, October 12th, 2022

- Articles

- Finance

It’s a question all borrowers ask: How can I get the best deal on my home loan? UNO’s chief financial officer and head of home loans, Jason Azzopardi, shares his home loan hacks with customers looking for the best deal.

By Peter Gearin, October 12th, 2022

- Articles

- Property

Changing your home loan when you move to a new house can present a few problems. It can also be a smart financial move for you. These are the things you need to consider when you move house and change loans.

By Alexi Neocleous, October 12th, 2022

- Articles

- Property

Super Bowl, a new Kardashian… it’s been a big week. Plus, the RBA has chosen to keep rates on hold for another month. With house prices dropping in most states, it could be a good time to consider your buying options.

By Hannah Tattersall, October 12th, 2022

- Articles

Moving out of the city to the coast or the country is a dream for many people. But before you jump in and buy a property in your ideal location, there are a few things you should think about.

By Meredith Williams, October 12th, 2022

- Articles

- Finance

Borrower requirements are diverse, so a feature that provides flexibility and choice for one mortgage holder may be an unnecessary cost to another.

By Sonja Koremans, October 12th, 2022

- Articles

- Lifestyle

A bit of extra money always comes in handy and no more so that right now. If you’re worried about your finances or just want to try to get ahead and build up a bit of a buffer, then you can think about trying to find a second source of income.

By Meredith Williams, October 12th, 2022

- Articles

- Property

- Finance

These are stressful times for Australia’s property investors. The popular image of property investors might be of the mega-rich, but the reality is that the majority are mum and dad investors who have worked and saved hard to buy an investment property for their retirement or to leave their children.

By Meredith Williams, October 12th, 2022

- Articles

- Covid-19 Support

By Meredith Williams, October 12th, 2022

- Finance

- Articles

It’s been a tumultuous year since commissioner Kenneth Hayne handed down his recommendations following the banking royal commission. But what has actually changed over the past 12 months and what impact has the commission had on the industries it explored?

By Meredith Williams, October 12th, 2022

- Articles

A number of home loan lenders have announced special measures and emergency packages to assist those affected by the ongoing bushfires. We have compiled a list of lenders, contact numbers and links to their websites to help you get in touch quickly and get the support you need.

By Meredith Williams, October 12th, 2022

- Customer Stories

- Articles

Nearing the end of a fixed loan term with one of the Big 4 banks, Lee and Danny were wondering if there were better loan options available to them. That’s when they stumbled across uno.

By Hannah Tattersall, October 12th, 2022

- Articles

- Finance

The RBA slashed the official cash rate by 25 basis points this week to just 0.75%. You’re probably wondering what this means for you and your home loan.

By Hannah Tattersall, October 12th, 2022

- Lifestyle

- Articles

Motherhood and Lifestyle blogger and popular influencer Olivia White (House of White) recently tested uno’s loanScore technology to see how her loan compared to others. Needless to say, she found the tool very useful.

By Hannah Tattersall, October 12th, 2022

- Articles

Your information is protected by bank-level security covered by an industry-first insurance policy.

By UNO home loans, October 12th, 2022

- Articles

- Customer Stories

Sydney-born Damien has taken his lifelong passion for music and technology and found professional success internationally as the founder and CEO of New York-based Blue Pie Records. But as anyone growing a business knows, things can be tricky financially – and Damien decided it was time to face the music on his home loan.

By Peter Gearin, October 12th, 2022

- Articles

- Finance

UNO Home Loans has revolutionalised the home loan market. Here's 8 reasons why we can get you a better, smarter deal on your home loan.

By Peter Gearin, October 12th, 2022

- Articles

- Finance

With so many new rates appearing daily, finding the best rate for your circumstances can be hard work – especially if you’re house hunting at the same time. So, why not let UNO do it for you?

By Hannah Tattersall, October 12th, 2022

- Articles

Borrowers looking to buy property in Australia’s hottest real estate markets are not likely to see any immediate improvement in home affordability based on an analysis of this week’s Federal Budget.

By Peter Gearin, October 12th, 2022

- Articles

- Property

You may think of it as old-fashioned, but adding a granny flat to your property can be a smart source of income under the right circumstances.

By Alexi Neocleous, October 12th, 2022

- Articles

- Property

Some loans are better than others, but the difference isn’t always obvious. Learn what makes a good home loan – from competitive rates to mortgage offset accounts, these features make all the difference.

By Alexi Neocleous, October 12th, 2022

- Articles

While selling your own home may seem overwhelming to some, it can actually be super simple, with websites set up to assist you in the process.

By Helen McMurdo, October 12th, 2022

- Articles

Loan to Valuation Ratio is a percentage that is calculated by dividing the amount of the loan by the purchase price or appraised value of the mortgaged property.

By UNO home loans, October 12th, 2022

- Articles

- Customer Stories

It's an issue confronting growing families – borrow to renovate their home or upgrade to a property that better suits their needs straight away?

By Peter Gearin, October 12th, 2022

- Articles

UNO Home Loans can help any first home buyer, such as 34-year-old David from NSW, get a loan that suits individual needs. See our mortgage calculator.

By Peter Gearin, October 12th, 2022

- Articles

An interest-only home loan leads to lower monthly payments. That’s only a short-term view, though. You’ll still have to handle the principal sum at some point. Know what you’re stepping into or an interest-only loan could come back to bite you.

By Alexi Neocleous, October 12th, 2022

- Articles

Multiple lenders now scrap for suitable people to lend money to, and offer a range of attractive, made-to-measure home loan deals.

By Peter Gearin, October 12th, 2022

- Articles

Debt consolidation can help you get your finances under control. Combining your debts into one means you only make a single monthly payment. You can even secure home loan products that offer debt consolidation.

By Caroline Roberts, October 12th, 2022

- Articles

Buyers and sellers need to be wary when an early offer is made on a property. Whether the sale is via auction or private treaty, it can backfire easily.

By Peter Gearin, October 12th, 2022

- Articles

Lenders Mortgage Insurance is a type of insurance that lenders take out to protect themselves in case the borrower defaults on the loan. Find out more here.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

What we can do is offer a free valuation for your target property. Just contact us on 133 866 or via online chat.

By UNO home loans, October 12th, 2022

- Articles

Property investors are being urged to start paying down their home loans, thanks to the rising costs of interest-only loans.

By Peter Gearin, October 12th, 2022

- Articles

- Finance

Need a little extra to buy your dream property? Hint: Tip #3 can help get you an extra $25,000 in borrowing power almost instantly

By Helen McMurdo, October 12th, 2022

- Articles

Don’t get too cocky if you were born in the Chinese Year of the Rooster – especially if you’re looking to buy or sell real estate.

By Peter Gearin, October 12th, 2022

- Articles

Once again the RBA cash rate has remained unchanged at 1.5%. We've summed up some solid data we've gathered after 1 year in operation.

By Vincent Turner, October 12th, 2022

- Articles

- Customer Stories

Emma needed help finding the right deal for a complex home loan structure. They had multiple loans from a number of banks and three properties.

By Peter Gearin, October 12th, 2022

- Articles

- FAQs

UNO is available on all digital devices. You can find us on the web through your laptop, desktop computer, tablet or mobile phone.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

No, your credit rating is based on your credit history. Using UNO won’t affect your credit history. Lenders refer to credit ratings when they consider loan applications.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO currently uses the industry-standard TLS certificate with 1024-bit encryption for your data security.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

The search order is determined only by the total cost of the home loan. While lenders pay commissions to get a higher listing on comparison sites, UNO is different – it arranges its home loans according to how suitable they are for your needs.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, we’re here to help you get a suitable home loan deal for your unique circumstances. That’s why it’s important that you discuss your needs with our experts to help ensure the product that’s recommended is right for you.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO gives you a completely transparent view of the home loans available to you from our panel of lenders. That’s why the home loan recommendations you discover through UNO are based entirely on your specific financial needs and circumstances.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO has an Australian Credit Licence through ASIC and all of our loan writers are accredited under that licence. We are also members of the Mortgage and Finance Association of Australia.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO is ideal for all private borrowers: first home buyers, refinancers, debt consolidators or anyone looking to upgrade or renovate their home.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

No. The home loan options UNO recommends to you are chosen based on their suitability for your situation and needs.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO is an online service that helps you broker a better home loan and get expert help when you need it.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, but how much you save on your mortgage payments through refinancing depends on a number of factors.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO is an online service that helps you broker a better home loan and get expert help when you need it. You can research and apply for your new home loan on one easy-to-use online platform.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Your lender chooses one of three methods to value properties – electronic valuation, drive-by valuation and in-house valuation.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Well, you won’t know that for certain until someone makes you an offer!

By UNO home loans, October 12th, 2022

- Articles

- FAQs

A pre-approval or conditional approval from a lender typically lasts 90 days.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

No one wants to borrow more than is necessary, of course, but it can be difficult to predict exactly how much you will need.

By UNO home loans, October 12th, 2022

- Articles

Six months ago interest only loans made a lot of sense for property investors. Today, the story is very different.

By Justin Bohlmann, October 12th, 2022

- Articles

Expecting a baby, or planning to start a family sometime in the future? You’ll be pleased to hear there are home loan options out there that factor in life changing events such as taking parental leave.

By Peter Gearin, October 12th, 2022

- Articles

There are a lot frustrated buyers out there, overwhelmed by selling agents’ tactics and sick of underquoting. Buyer’s agents exist to help these people.

By Peter Gearin, October 12th, 2022

- Articles

We explain all product features you might need to know during your home loan process.

By Helen McMurdo, October 12th, 2022

- Articles

Get noticed, show confidence, have a plan and get the timing right and you can score the winning bid at your next home auction. Click to find out more.

By Peter Gearin, October 12th, 2022

- Articles

- FAQs

It’s best to contact your home loan lender immediately if you suffer a loss of income for any reason.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

The decision to fix your interest rate will depend on your goals, financial situation and risk appetite. It is best to understand how fixed and variable interest rate options work and the pros and cons for both.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Lenders Mortgage Insurance (LMI) is paid on all home loans by the lender to a third party or in-house insurance organisation.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

A comparison rate gives you an indication of the true cost of a loan. It’s a way of comparing loans equally by including known fees (upfront, ongoing and exit) on top of the interest rate and is calculated on a $150,000 loan over 25 years.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

There are many other costs you need to think about when organising a home loan: application fees; valuation fees; settlement fees; ongoing account keeping fees; variation fees; repayment holiday fees; security substitution fees; discharge fees...

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Lenders in Australia calculate and accrue interest charges every day.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

This includes interest-only loans, low-doc loans, fixed rate and variable rates, loans for first home buyers, as well as loans for investment properties.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

You can approach a bank directly if you wish but UNO gives you access to a large number of major and specialist home loan lender in Australia.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, UNO is accredited with a number of lenders, which means we can offer advice on a range of home loan and credit products.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, UNO is accredited with a number of lenders, which means we can offer advice on a range of home loan and credit products.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, just speak to your home loan expert about starting a second application.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Use the Profile screen which you can access here to edit any of the data for your home loan product search.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

You may need to verify your identification, and this is likely to depend on whether you’re already banking with your preferred home loan lender.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Your uno Dashboard contains a to-do list and a document checklist. These have been tailored by our home loan experts to show what needs to be done at every step.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Signing documents for your loan contact will vary depending on the lender. You may sign documents with your solicitor or at the lender’s branch.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Just log into your uno account and check the uno Dashboard to see your application status. Otherwise, you can always contact us on 133 866 or through online chat.

By UNO home loans, October 12th, 2022

- Articles

It's a question for all investors; how much should I invest renovating to add value to my property? Click to read our guide on renovating for profit.

By Peter Gearin, October 12th, 2022

- Articles

UNO provides all the information you need to choose the home loan that best fits your needs. Through UNO, you have the same tools mortgage brokers have been using for years, which means you have full transparency over what's available and total control over the entire process.

By UNO home loans, October 12th, 2022

- Articles

Instead of saving for all the deposit, your family can offer a family guarantee. Learn how you can afford your first home with a family guarantee.

By Vincent Turner, October 12th, 2022

- Articles

- Finance

Mortgages come with many variables, but with a mortgage calculator you can factor in all the numbers. Discover the impact of interest rates, term length, and more on your home loan.

By Caroline Roberts, October 12th, 2022

- Articles

Documentary evidence that verifies application data, used by both UNO and lenders to confirm the details that a loan applicant has provided throughout the application process.

By UNO home loans, October 12th, 2022

- Articles

Serviceability describes the method lenders generally use to assess a consumer’s ability to repay a loan. This can based on the loan amount, the borrower’s income, expenses and other commitments.

By UNO home loans, October 12th, 2022

- Articles

The current credit licensing and governance framework introduced in 2011 to enforce responsible lending for credit providers, including brokers.

By UNO home loans, October 12th, 2022

- Articles

A mortgage broker is someone who negotiates with banks, credit unions and other credit providers on your behalf to arrange home loans. They also assist with application preparation.

By UNO home loans, October 12th, 2022

- Articles

A mortgage adviser is the same thing as a mortgage broker: Someone who negotiates with banks, credit unions and other credit providers on your behalf to arrange home loans. They also assist with application preparation.

By UNO home loans, October 12th, 2022

- Articles

If you’re looking to buy a new home, you need to consider what you’ll do with your current home. Should you sell first and then buy? Or buy first and sell later?

By Alexi Neocleous, October 12th, 2022

- Articles

- FAQs

An offset account can make a massive difference to the total cost of a home loan, but only if you know how to use it effectively.

By UNO home loans, October 12th, 2022

- Articles

If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or discharge form.

By Hannah Tattersall, October 11th, 2022

- Articles

- FAQs

Ever wondered: What size deposit will I need? What can I do if I have less than required? How does it benefit me if I have more than what’s required?

By UNO home loans, October 11th, 2022

- Articles

- Finance

Don’t spend another year shedding tears, and dollars, because you didn’t refinance your mortgage. Let UNO do some huffing and puffing as we trim down your mortgage, pop it down your chimney and under your tree in time for Christmas morning.

By Cath Fowler, October 11th, 2022

- Articles

- Finance

When you’re self-employed and can’t prove your income easily, low doc loans come to your rescue. Here are some tips on how you can choose the right low doc loan for you.

By Caroline Roberts, October 11th, 2022

- Articles

- Finance

Also known as equity lines, lines of credit offer access to large sums of money, but come at the cost of paying interest. Still, you can make your line of credit work for you.

By Alexi Neocleous, October 11th, 2022

- Articles

How a Sydney executive refinanced her multi-million dollar portfolio and locked in the absolute best 5 year deal.

By Helen McMurdo, October 11th, 2022

- Articles

- Finance

- Property

Your real estate agent may appraise your property. However, this isn’t the same as the valuation a lender will carry out. Let’s look at the differences between the two.

- Articles

- FAQs

UNO is Australia’s first Active Home Loan Manager helping Australians start on a great home loan and stay on a great home loan as long as they have one.

By UNO home loans, October 11th, 2022

- Articles

- Property

It’s important to think about more than your home loan when buying a property. You also have to consider its susceptibility to natural disasters.

By Alexi Neocleous, October 11th, 2022

- Articles

- Finance

Most lenders look at your employment history when considering your home loan application. They want to see that you earn a stable income and you’ve been in the same job for a while. This may make it hard to get a loan if you’re in your probationary period.

By Alexi Neocleous, October 11th, 2022

- Articles

- Finance

Many first-time buyers rely on guarantors to help them get home loans. This helps the buyer but places the guarantor at risk. However, there are several things that guarantors can do to reduce their risk.

- Articles

- Finance

Choosing the right type of investment property involves much more than choosing the right home loan. There are several factors you must consider before coming to a decision.

- Articles

- FAQs

Yes, uno helps you choose from the best loans for owner-occupied homes and investment properties.

By UNO home loans, October 11th, 2022

- Articles

- Finance

UNO shows you how to go from a refinance 'dreamer' to a 'do-er' in 3 easy steps

By Meredith Williams, October 11th, 2022

- Articles

First home buyers may be able to buy a home sooner after the NSW government has slashed stamp duty for new homes and land.

By Meredith Williams, October 11th, 2022

- Finance

- Articles

At uno, we’ve analysed the amount Australians are potentially wasting on their home loans and estimate it to be $4.2 billion a year. That’s why we’re helping Australians fight home loan waste today and for the whole time they have a home loan.

By Anthony Justice, October 11th, 2022

- Articles

- Video Explainers

Should I fix or stay variable? Well, it depends

By Vincent Turner, October 7th, 2022

- Finance

- Articles

The 2018 budget includes investment in new major rail and public transport infrastructure, which uno Home Loans founder and CEO Vincent Turner says could drastically impact housing trends across the country.

By Hannah Tattersall, October 7th, 2022

- Articles

- Guides

Ready to make a meaningful change to your financial situation? Head to UNO to check out our property investing guide for helpful advice and pro tips.

By UNO home loans, October 6th, 2022

- Customer Stories

- Articles

Even though our name is uno and our plan is to be Number 1, we work as a team to help our customers.

By Hannah Tattersall, October 5th, 2022

- Glossary

- Articles

LVR is a percentage determined by dividing the value of your property by the value of your current or intended home loan. For example if your property Valuation was $1,000,000 and your Loan Value was $830,000 then your LVR would be 83%

By UNO home loans, October 5th, 2022

- Articles

- Property

Deciding where to invest will depend on a buyer’s individual goals, how much they have to spend and what they might already have in their portfolio. Having some insider knowledge also doesn’t hurt. We chat to some experts about their predictions for 2018.

By Hannah Tattersall, October 5th, 2022

- Articles

- Guides

Is buying off the plan a smarter choice? Learn more about the benefits and risks that will help you decide.

By UNO home loans, September 22nd, 2022

- Video Explainers

- Articles

Using equity to increase the value of your property? Focus on these things

By Vincent Turner, September 21st, 2022

- Articles

- Guides

So you’re looking to buy property? As Australians, it’s part of the dream – as well as high up there on the dinner party conversation list.

By UNO home loans, July 28th, 2022

- Articles

- Finance

- Property

You could have all sorts of reasons for wanting to buy a second piece of real estate. However, you need to make sure you’re prepared before you commit your money towards a second property.

By Alexi Neocleous, July 28th, 2022

- Articles

- Finance

One of these first homebuyer schemes may be the final piece in the puzzle on your journey to home ownership.

By Sarah Megginson, July 28th, 2022

- Articles

- Guides

Need to know if you can get a fast home loan approval? We outline all the information and steps required in getting fast approval.

By UNO home loans, July 28th, 2022

- Articles

- Finance

Choosing whether to structure your home loan with a fixed or variable rate is not an insignificant decision. You’ll need to consider your own circumstances, and the state of the economy, along with expert advice.

By Alexi Neocleous, July 11th, 2022

- Articles

- Guides

There is no magic number when it comes to a home loan deposit, however in Australia the majority of lenders require you to have saved 10% of the property’s value (a couple of lenders may only require 5%).

By UNO home loans, July 11th, 2022

- Articles

- Finance

By the time you add up the cost of presents, an indulgent feast and a holiday with the kids, come Christmastime your bank account can end up feeling less Ho Ho Ho and more no, no, no.

By Cath Fowler, July 5th, 2022

- Articles

- Buying

Real estate auctions require you to prepare well before you enter the auction room.

By Alexi Neocleous, July 5th, 2022

- Articles

- Glossary